Serious Subject To All In Package By Jeff Watson – Free Download Course

Learn How To Build Your Wealth with Subject To and Creative Real Estate Investing.

✅ About This Course:

✅ Course Author: Jeff Watson

✅ Official Course Price: $4197

✅ Free For Our VIP Members? : Yes

✅ Download Links : Mega & Google Drive

✅ Course Size : 18.96 GB

✅ Updatable? : Yes, all future updates included.

✅ Sales Page : You can check at the bottom of this page.

🏆 Here’s What You Get & Learn With This Course:

Taxation and Structuring Sub To & Wraps (Hyre & Watson)

+ Expanded “Sub To” Document Library (Modules 1-4: Acquire, Finance, Sell, ROTH)

+ Papering Up a “Sub to” Deal

+ Bonus Material

That is why I have developed the Serious Subject To System for you. I am on a mission to educate and help investors do Subject To transactions correctly, and in a way that is good for the seller, good for you and will protect you for years to come.

Join Serious Subject To today to get started on your ‘subject to’ real estate investing journey! We provide you with the knowledge and resources you need to make smart, profitable decisions in your real estate investing ventures.

By joining the ‘Serious Subject To’ community, you’ll gain the knowledge and confidence you need to take advantage of the benefits of ‘subject to’ investing, such as low upfront costs, potentially higher returns, and the ability to acquire properties quickly. Plus, with our guidance, you’ll be able to avoid the potential risks and pitfalls associated with learning from unreliable ‘experts’ or going it alone.

Module 1: Acquire

Forms related to acquiring property

ADDENDUM TO CONTRACT FOR SALE AND PURCHASE

ADDITIONAL ACKNOWLEDGEMENTS OF SELLER AT CLOSING

AGREEMENT TO PURCHASE REAL ESTATE SUBJECT TO EXISTING MORTGAGE

ASSIGNMENT OF MORTGAGE ESCROW ACCOUNT

AUTHORIZATION FOR RELEASE OF RECORDS

CLOSING INSTRUCTIONS FOR ACQUISITION

DECLARATION OF TRUST AND TITLE HOLDING TRUST AGREEMENT

DTI INSTRUCTION LETTER

DUE-ON-SALE ACKNOWLEDGEMENT

DURABLE LIMITED POWER OF ATTORNEY FOR PROPERTY, MORTGAGE AND INSURANCE

WARRANTY DEED TO TRUSTEE

MEMORANDUM OF TRUST

Module 2: Finance

Forms related to financing property

COMMERCIAL PROMISSORY NOTE, IRA LOANS, 2nd lien for arrearages

COMMERCIAL PROMISSORY NOTE, IRA LOANS, 3rd lien for seller finance portion

COMMERCIAL PROFIT PARTICIPATION PROMISSORY NOTE, IRA LOANS, 2nd lien

DEED OF TRUST private lender second

DEED OF TRUST seller subordination

MORTGAGE, Private Money second

MORTGAGE, Seller-Finance Subordinate

Module 3: Sell

Forms related to the sale of property

ACKNOWLEDGEMENT Due on Sale in Land Contract

CLOSING INSTRUCTIONS FOR DISPOSITION

DTI Instruction Letter

WRAP ALL-INCLUSIVE PROMISSORY NOTE

MORTGAGE, Private Money second

Module 4: ROTH & Subject To’s

2. Taxation and Structuring “Sub To” & Wraps

In these videos, John and I deliver common sense, practical training and wisdom on not only what the tax law is, but how to adjust your business to achieve the desired result of avoiding phantom income tax when you are buying property from a burned-out landlord, maximizing your long-term capital gains, structuring installment sales, and having information to help you negotiate a better deal with your seller and buyer.

We also break down in detail what it means to be a dealer and the tax significance of that versus being a long-term capital gains investor.

All this information is in a format that you can share with your tax preparer or accountant to help you educate them.

These videos alone are worth much more than the price of this course.

What do these videos include?

Module 1: Laying the Foundations

Lesson 1 – Introductions & Why You Should Listen to Us

Lesson 2 – Foundational Concepts

Lesson 3 – Installment Sales Treatment

Lesson 4 – Capital Gains Overview

Lesson 5 – Deed vs Deed of Trust vs Mortgage vs Promissory Note

Lesson 6 – Default vs default “Due on Sale”

Lesson 7 – Sub2 & Wrap Defined

Lesson 8 – Case Law: Webb, Voight, Goodman

Lesson 9 – Summary

Module 2: Installment Sales

Lesson 1: Why It Matters

Lesson 2: Walk through

Lesson 3: Downside

Lesson 4: Summary

Module 3: Installment Sales

Lesson 1 – Disclosures and regulators

Lesson 2 – Trusts: Reality vs Fantasy

Lesson 3 – Depreciation recapture, Dealer status and Selling considerations

3. Papering Up a “Sub-to” Deal

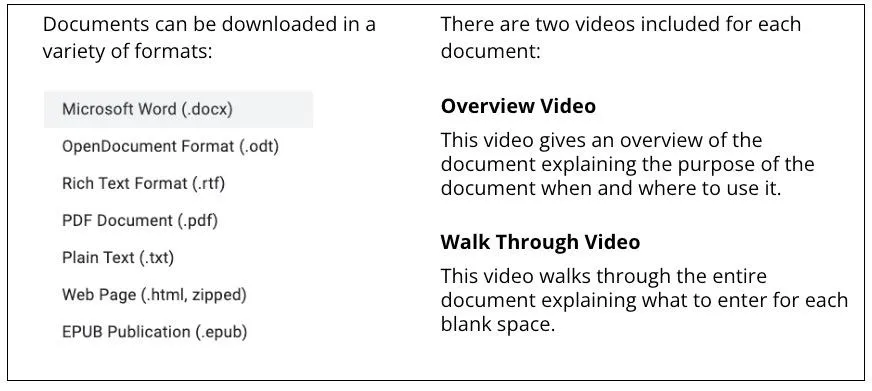

In this three part video series, I walk a friend through the process of using the Acquire documents to create the necessary paperwork and documentation to secure his “Subject-To” deal.

The “Sub To” Overview and Walk Through videos are powerful in themselves. Seeing them implemented in a real life example walking through the use of these documents will take your knowledge to a whole new level.

Lesson 1 – Disclosures and regulators

Lesson 2 – Trusts: Reality vs Fantasy

Lesson 3 – Depreciation recapture, Dealer status and Selling considerations

4: Q&A Session for Taxation and Structuring “Sub To” & Wraps

This session is jammed packed with golden nuggets for serious sub-to investors regarding tax and legal implications.

This video features John Hyre and me answering questions about our premiere Taxation and Structuring Sub To & Wraps

course.

When we opened up that other course for an early BETA preview, we were surprised to find that one-third of the people who snatched it up were either attorneys, accountants or real estate coaches. We knew we hit gold as they told us that no one is teaching the things John and I teach in this course and investors absolutely need to know this stuff.

Listen and learn from what these experienced and newbie investors were asking John and me about. This will prime the pump for what you need to be thinking about in becoming a serious sub-to investor.

5. Using Title Holding Trusts in Subject-To Transactions

A detailed training on using trusts in Subject-To transactions, such as trustee and beneficiary selection. The powerful advantages of using a trust to buy “subject to” are explained in detail.

The current economic conditions provides an opportunity to leverage this strategy.

Bonus #1: Creative or Criminal ($500 Value)

Six major problems to avoid when structuring your Subject-To real estate deals.

This is recent speech given by Jeff to a national audience regarding subject to transactions, various problems with them, and how to overcome those problems. Including:

The 3 worst sources of legal advice for real estate investors.

Sub-To problems you must avoid.

Bonus #2: How to Do Your First Few “Subject To” Real Estate Deals Without Fear of making Newbie Mistake, dealing with Sellers Remorse and owing too much in taxes to the IRS. ($345 Value)

This video shares the necessary steps to structure a deal using the “Subject-To” technique and what you need to know to protect yourself from bad deals, unwanted lawsuits and unnecessary taxation by the IRS, or worse.

Bonus #3 Three Power Questions to ask Sellers to Begin the Conversation about a “subject-to” purchase. ($300 Value)

This video shares the details of Step 1: Finding the Deal, presenting the questions you need to ask sellers to determine if “subject-to” is a viable solution.

✅ Great X Courses Guarantee : At Great X Courses, we insist in providing high quality courses, with direct download links (no paid links or torrents). What you see is exactly what you get, no bad surprises or traps. We update our content as much as possible, to stay up to date with the latest courses updates.

You can find more info on the sales page here.